Ben Rothfeld, Founder, Plannerben | Anecdata

Unless you work in the automotive industry, you probably don’t think of mobility services such as Uber or autonomous vehicle platforms such as Google’s Waymo as a business problem. “Oh, sure,” you might think, “they can keep Ford and GM executives up at night, but it’s not my problem.”

My research suggests that mobility solutions will have a grand impact on industries far behind automotive. As people abandon car ownership, new usage patterns will emerge that touch many types of businesses. Brands that anticipate these usage patterns correctly will enjoy a huge advantage over brands that stick to the script. As always, consumers will vote with their feet. Will they vote for your brand?

Intel, which has invested heavily in autonomous vehicle technology, has coined the term “passenger economy” to describe a future—30 years off—in which we let the machines do all the driving. They predict that this passenger economy will be worth $7 trillion in transportation revenues. I will argue that the passenger economy already exists in its infancy and that $7 trillion may represent a very conservative figure in the near term.

Let’s explore what we can expect from the passenger economy over a near-term time frame, which industries it will affect and how they should respond.

Now to five years out

As of right now, Uber brings in about $20 billion per year, putting it just ahead of Eli Lilly (#141) on the Fortune 500. Emarketer estimates that there are 15 million US rideshare users. Based on the Pew Center’s estimate that 17% of users ride weekly or more often, that means that as of today, the passenger economy has a universe of 2.5 million adults. If they all lived in the same place, it would become the fourth largest city in America (sorry, Brooklyn). However, these numbers represent only a starting point. Emarketer also projects annual growth for rideshare services at 6.29% through 2020.

Even the machines themselves will start to change in the five-year timeframe. More cars will run on electricity, which will in turn mean decreased need for gas stations and, due to electric cars’ fewer parts, repair shops. We may even see our first truly autonomous cars by 2023, based on testing that Uber began last year in Pittsburgh with robo-taxis. Moreover, in what may be the only case of bipartisan legislation written this year, Congress plans to streamline testing rules for autonomous vehicles, speeding up their development.

The auto industry has begun to take notice and to respond accordingly. Ford replaced its CEO with the head of its autonomous vehicle unit. Every major manufacturer has invested in rideshare, car sharing (e.g. Zipcar), autonomous vehicles or all of the above. The major manufacturers have agreed to implement automatic emergency braking standard by 2022, a step towards full automation.

I’ll go out on a limb and predict that by 2023, those 2.5 million frequent passengers mentioned above will double and maybe triple.

Who’s affected?

We can predict which industries the passenger economy will disrupt by looking at where these passengers go. According to rideshare ad network (of course they exist) Vugo, the top 20 destinations contain some obvious places, such as homes and offices, as well some unexpected ones, like bakeries and coffee cafes. They also fall neatly into four main groups:

- Dining & entertainment (restaurants, bars, night clubs, sports events)

- Retail (stores, department stores, grocery stores, malls)

- Travel (airports, transit stations, hotels)

- Health & Wellness (Fitness clubs, doctor’s offices, pharmacies)

Remember that $7 trillion figure Intel estimated for the 2050 passenger economy? Retail alone accounted for $5.4 trillion in 2015, so even if only a small part of retail feels the impact of mobility solutions, it will only add to the number for the true passenger economy.

All these industries need to think about what happens when their customers arrive in something other than their own car or mass transit. While some implications may be obvious for some industries (why not upsell an extra drink at TGI Friday’s if your customer isn’t driving home?), every brand needs to ask some tough questions:

- Might vehicle automation or ride-share make trips to my location unnecessary?

- How might my customers’ behavior change if they don’t have to drive to my location?

- How might what we sell change based on how customers may bring it home?

- What do we need to do to make our business more attractive to passengers?

We’ll spend some time discussing that last point because it applies most broadly.

Putting your brand on the digital map

Maps will become the new search engines.

Just as search engines became our default for navigating the web, digital maps will help us curate the real world. Mind you, we may not actually see those maps; just as we often access search engines by a browser address bar, we will rely on maps when we ask our devices simple questions like “where can I get good pizza?” In the background, maps will blend location data with other factors to provide answers.

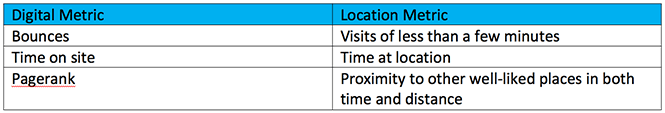

A large part of getting good referrals from maps lies in the same things that help any business perform in the digital economy: good service that results in positive reviews and other digital metrics. Just as we look at digital metrics, we will need to look at location metrics. Fortunately, these metrics work in similar ways:

What might improve those numbers? Here are some ideas:

- Make your brand more inviting to ride share drivers by offering them places to wait, non-alcoholic beverages and (especially) bathrooms

- Integrate with ride share services they way Taco Bell is testing now; you can use your Lyft app to put in an order and have your car take you there on your way home from the bar

- Use credits for rideshare as an incentive that also makes it easier for customers to patronize your locations

Longer term, your locations may need to change to accommodate changes in mobility. Expect smaller parking lots and/or larger structures. Lobbies may include more windows to allow customers to see their rides approaching. Retailers may enhance their pickup windows/bays to become better experiences for shoppers. It’s hard to imagine life without cars, but once you start to imagine it, the world literally changes.

Leave early to avoid the traffic

With 2.5 million members and climbing, the passenger economy will become an increasingly important reality in the near term. Too many people have too many places to go with too little time to worry about their own cars. As manufacturer and startup offerings enable even more flexibility in mobility, the passenger economy will gather momentum even faster.

As we’ve seen, the passenger economy will make waves far beyond Detroit and Silicon Valley. Nearly every business with a physical location must adapt to customers who arrive and depart in someone else’s vehicle—or not at all if delivery services continue to expand.

While the time has not arrived to replacing parking lots with glamorous portes cocheres, marketers in dining and entertainment, retail, travel and health and wellness should start piloting programs now to address this emerging segment.

Ladies and gentlemen, start your engines.

Ben Rothfeld founded Plannerben | Anecdata to address an unmet need in marketing: making sense of the immense amount of information that marketers have at their disposal. Plannerben | Anecdata develops fresh insights by integrating behavioral data such as digital analytics and marketing databases with market research. The two streams of information help create a more nuanced and realistic view of the consumer.

Previous to founding Plannerben | Anecdata, Ben spent 20 years as a researcher and strategist at ad agencies such as Kirshenbaum Bond & Partners and DiMassimo, data provider Acxiom and financial services giant Bloomberg. He holds a BA in ancient history from Swarthmore College and an MA in a related field (advertising) from the Newhouse School of Syracuse University. Ben can be reached at ben@plannerben.com and 646-258-9394.